Should we be expecting a significant drawdown in the stock market?

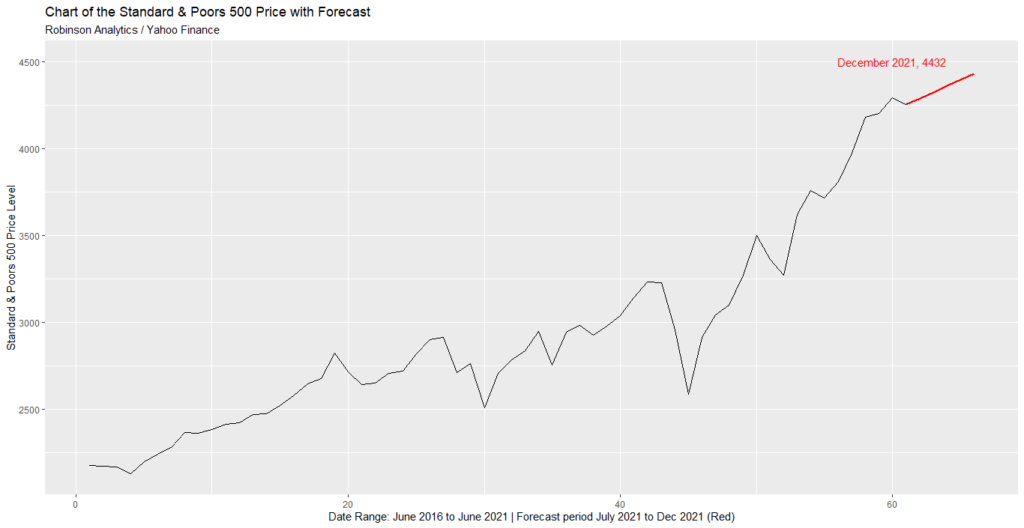

I am releasing my updated stock market forecast for the remainder of the year from my Analytics Model. My June 2021 forecast for year-end price level of the Standard and Poor’s 500 is 4,432 (I have a high confidence level that the price level will come in between 3,756 and 5,108). See the chart below. This new forecast is an upgrade from my December 2020 forecast of a Standard and Poor’s 500 price level for 2021 of 4,066. That is an 9% improvement from my price level forecast for 2021 in December or an improvement of 5 percent from current levels in June 2021. So we should prepare for more modest gains for the remainder of 2021.

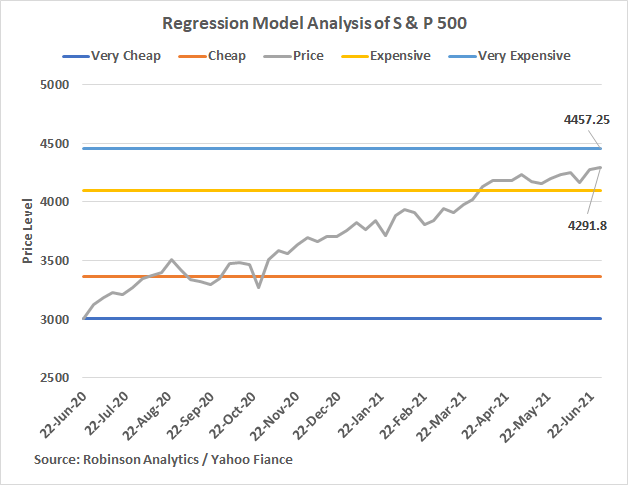

When I take a look at my Regression Model, it is communicating to me that we potentially have some room to run here. The market is registering as expensive but not very expensive. See the chart below. The very expensive price level in the chart is 4,457, which is slightly above my Analytics Model forecast of 4.432.

Robinson Analytics takes data science and applies it to the Stock Market to provide you with some of the highest-return investment ideas. To learn more about Robinson Analytics Investment Newsletter, click here.

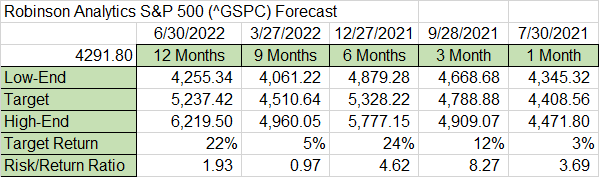

When I take a look at my probability model below, I see that the best time-frame to invest in the market is over the next 3 months period on a risk adjusted basis. This model is also forecasting a pull-back in the markets the first quarter of 2022 of approximately 15% So this model is forecasting a pull-back at this time.

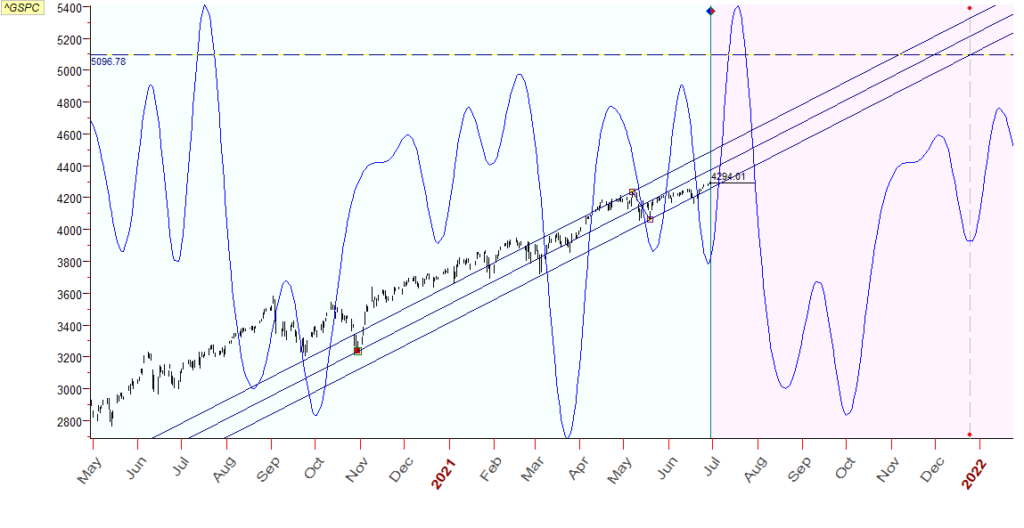

When I take a look at my Cycles forecasting model, It is forecasting improvements in the market the first few weeks of July and some downward pressure risks for the market by or before August 20, 2021, October 2, 2021 and December 25 2021 time periods. See the chart below.

In summary, we should continue to see improvement of the Standard & Poor’s 500 price level as 2021 unfolds. However, my Cycles model is forecasting three potential down-side risk periods over the next 6 months. My probability model is forecasting that the next 3 months is the best time to be in the markets on a risk-adjusted basis. However, my probability model is also forecasting a pull-back the first quarter of 2022 at this time.

“We use analytics on your work and business processes to gather the critical insights that you need to impact your business performance.” Click here to schedule a complimentary discussion session about how Robinson Analytics can help you. To learn more, you can access his website at www.robinsonanalytics.com.