What’s going on with Interest Rates?

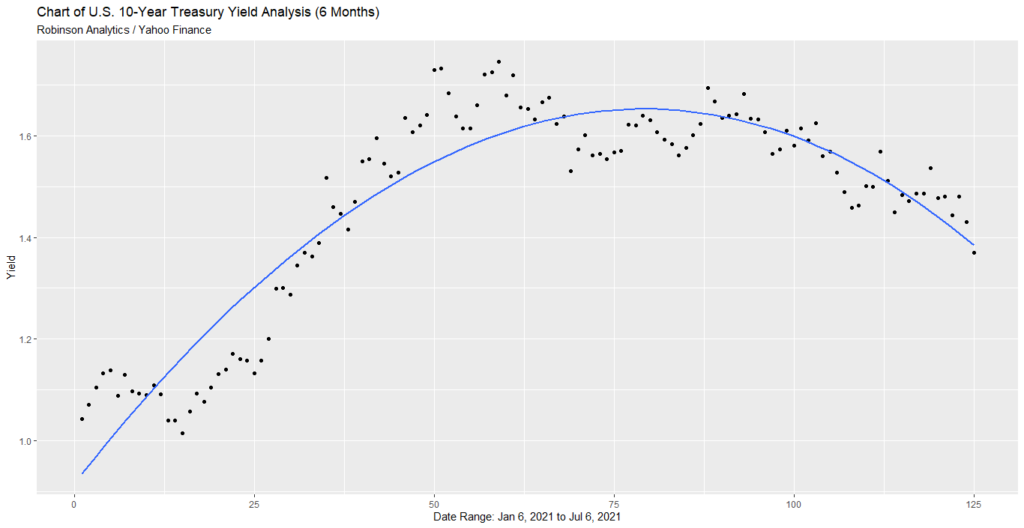

When I did some analysis on 6 months of the 10 year treasury bond yield, it looks challenging over the next 3 months. See the chart below.

This analysis is telling me that we could see a decline in interest rates over the summer. Which communicates that bond investors are not all that confident in the economy in the near future. Even as we created more than 800k jobs in June 2021 (which is coincident economic indicator)

Robinson Analytics takes data science and applies it to the Stock Market to provide you with some of the highest-return investment ideas. To learn more about Robinson Analytics Investment Newsletter, click here.

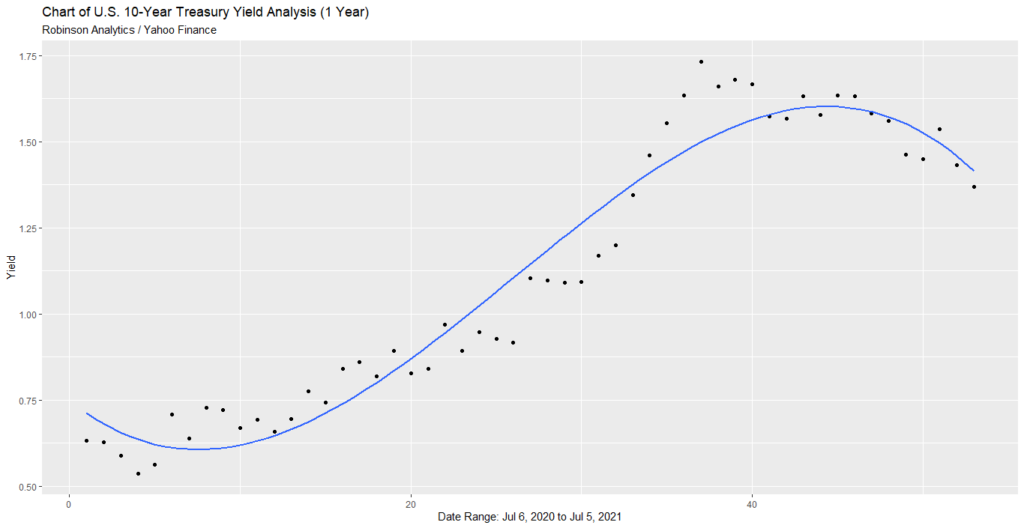

So, I ventured out a little further. See the 10 year bond yield chart for the past year below.

This analysis forecast that the bond market yield is going to be stable to constrained over the next 6 months. It would definitely appear to me that the inflation story is definitely over hyped. Bond investors are not concerned about inflation but are concerned with the economic future and price level of the stock market.

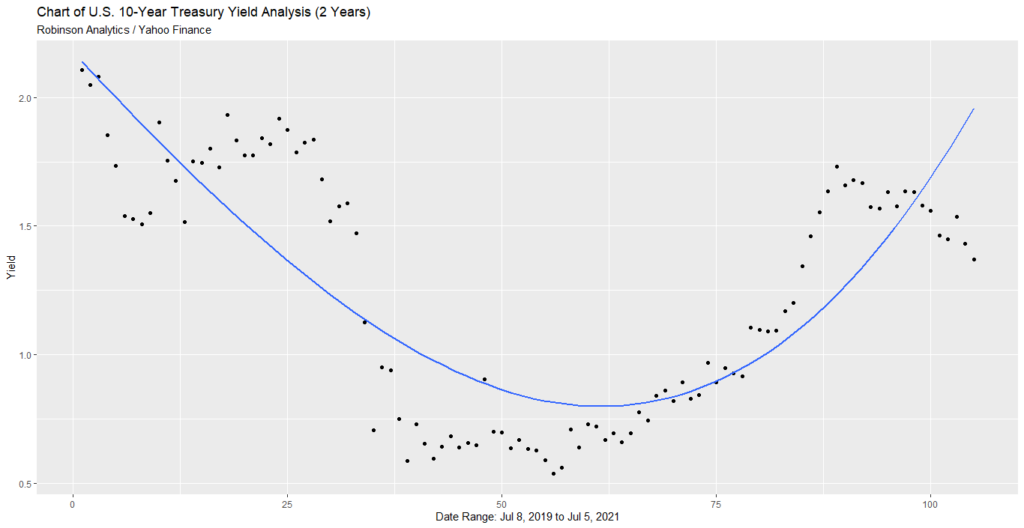

It’s not until I get to a year from now, that my analysis forecast some upward movement in the bond market. So we should definitely be expecting some upward movement in interest rates by the middle of next year. However, the time between now and then may be mannered.

“We use analytics on your work and business processes to gather the critical insights that you need to impact your business performance.” Click here to schedule a complimentary discussion session about how Robinson Analytics can help you. To learn more, you can access his website at www.robinsonanalytics.com.