Robinson Analytics: Is the Economy Growing Stronger or Weaker?

The economy is getting stronger and the bond market is confirming that. I have graphed in a few charts below the yield action on bonds and how they relate to the stock market. This gives us insights as to what is going on with the economy.

Robinson Analytics takes data science and applies it to the Stock Market to provide you with some of the highest-return investment ideas. To learn more about Robinson Analytics Investment Newsletter, click here.

When I take a look at a national survey of manufacturing leaders around the country, they are communicating confidence in the growth of the economy. For example, the index that measures business confidence for the manufacturing industry, Manufacturing PMI® , indicates for January 2021 that the economy is currently expanding at an annualized rate of 4.4%. Manufacturing accounts for only approximately 11% of the economy, but is a strong leading economic indicator.

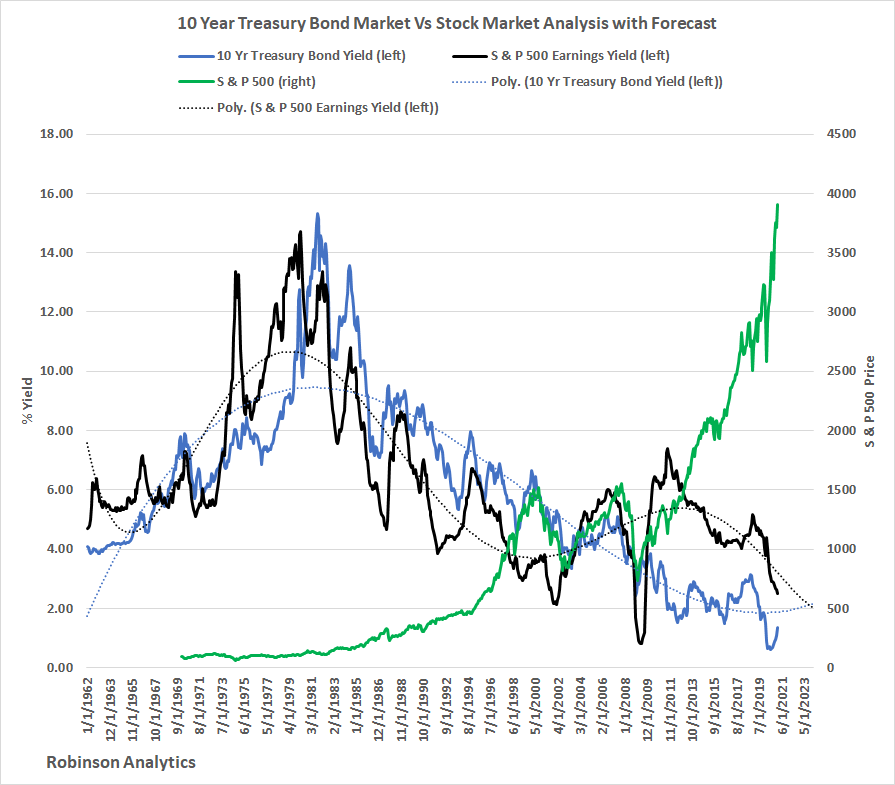

As you can see from the chart below, 10 Year United States Treasury yields are rising (See the blue line). This is a confirmation that the economy is improving. However, it also means that:

- Interest rates for mortgages will begin to rise,

- rates for auto loans will begin to rise and

- business loans will become more expensive.

In other words, as interest rates rise it reflects an improving economy, but as the rising cycle of interest rates continue, it will start to be a drag on the economy eventually.

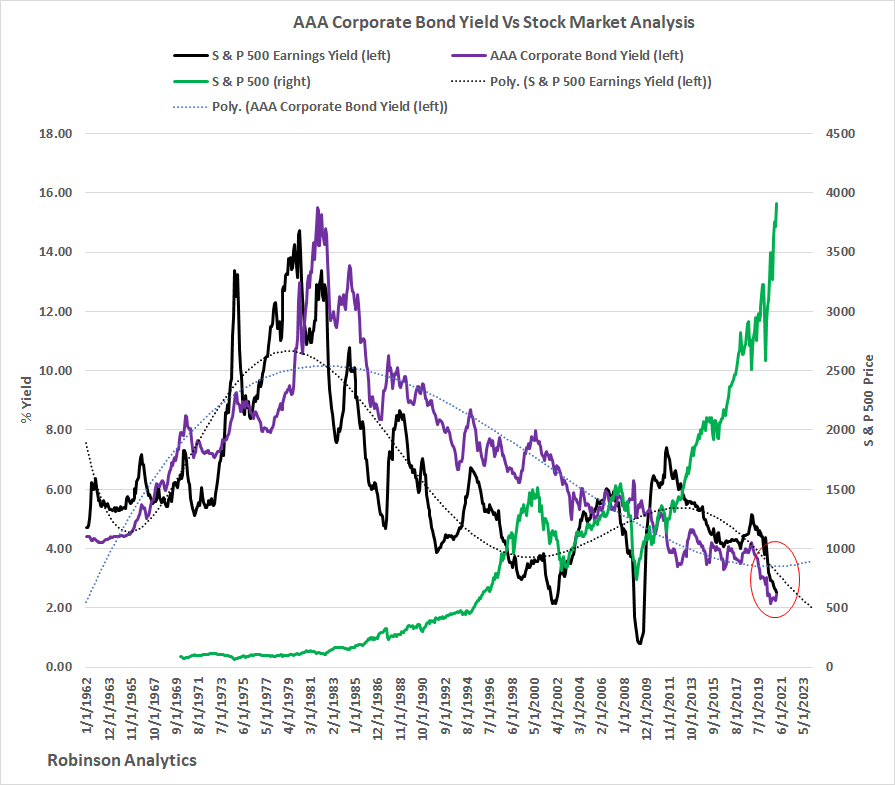

In the chart below, I chart the AAA Corporate Investment Grade bond yields. As you can see, the AAA bond yield is almost equal to the earnings yield of the S & P 500 stock market index. Which means that they are becoming almost as good an investment as the stock market overall.

These corporate bond yields will fluctuate with the U.S. Treasury yields. As U.S. bond yields increase, so will AAA bond yields. This will ultimately syphon off investment from the stock market and increase the borrowing of Corporations eventually.

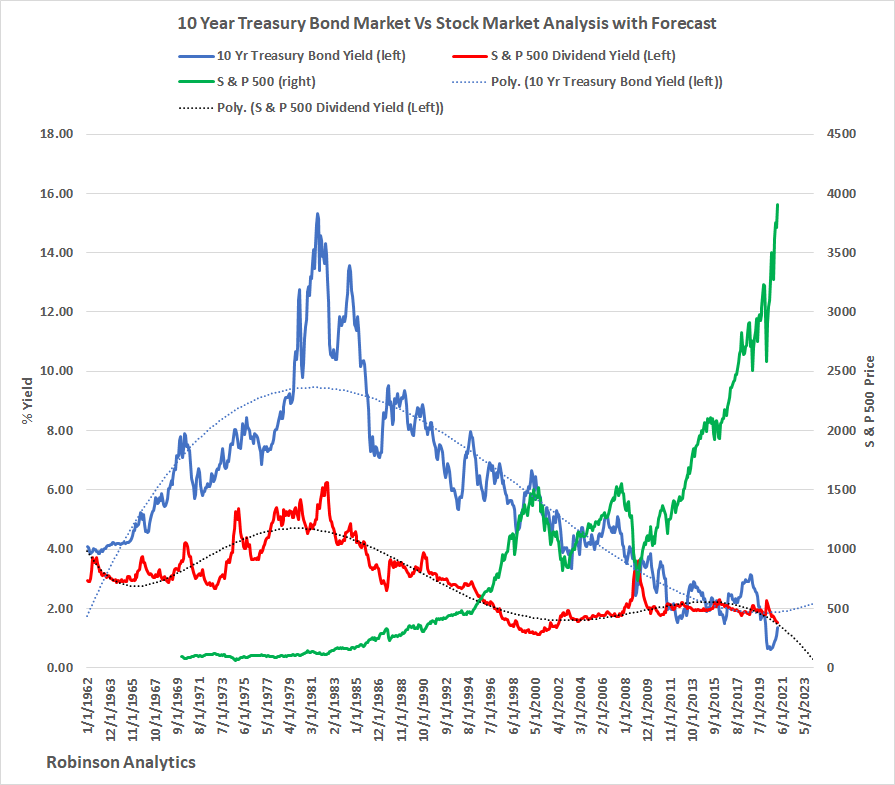

Lastly, when I take a look at the 10 Year Treasury bond yield versus the Standard & Poor’s 500 Dividend yield, the yield on the bond market is approaching and almost equal to the dividend on the stock market overall. This will also start to syphon off investment from the stock market and could be a sign that the economy may be facing some headwinds in the future. See the blue and red lines on the chart below.

To access my National Economic Forecast, click Robinson Analytics 2021 Economic Forecast

“We use analytics on your work and business processes to gather the critical insights that you need to impact your business performance.” Click here to schedule a complimentary discussion session about how Robinson Analytics can help you. To learn more, you can access his website at www.robinsonanalytics.com.