Robinson Analytics 2021 Economic Forecast (March Edition)

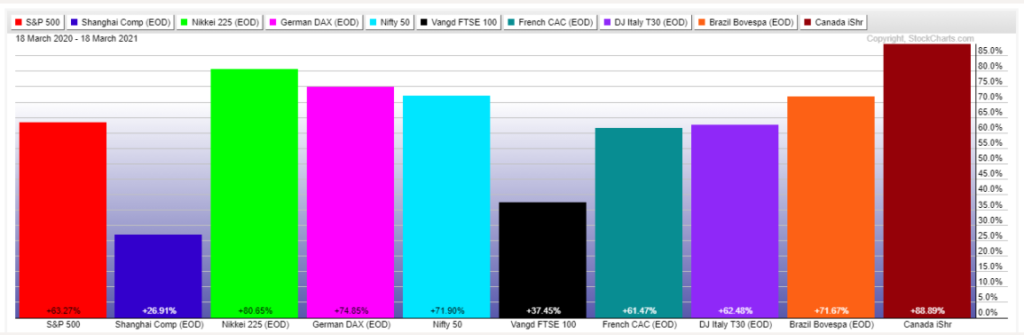

A lot has changed since my December 6, 2020 forecast for 2021. My financial markets analysis is on the top 10 economies in the world. See the chart below. The markets are currently forecasting that Canada’s main street economy will do the best the next 6 (September 2021) to 9 months (December 2021), with Japan’s main street economy performing second best and Germany performing third best, India’s main street economy performing fourth best, Brazil’s main street economy will perform fifth best, United States will perform sixth best (decline from second best in my December 2020 forecast), Italy will perform seventh best and France will perform eight best, the United Kingdom will growth ninth best and China will grow tenth best.

The world economy is currently forecast to grow by 5.5% (increase from 5.2% in December 2020) in 2021. The world economy will need to grow by 3.6% to recover to where it was at the beginning of 2020. My current estimate is that we are on track for the world to recover from the 2020 recession by August 2021 (was November 2021 in my December 2020 forecast).

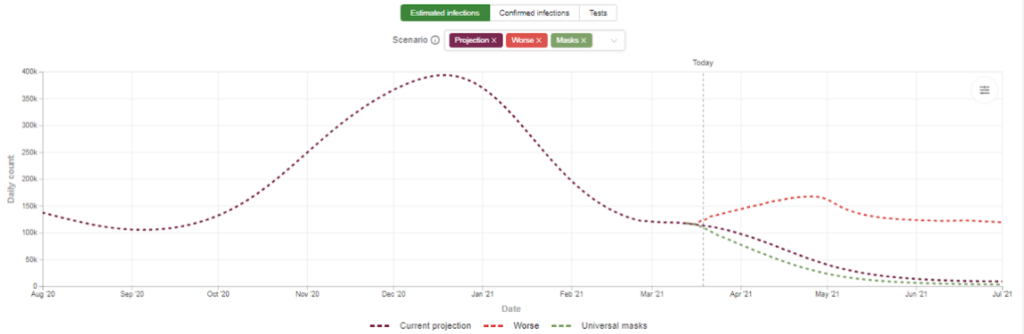

The Institute for Health Metrics and Evaluation (IHME), an independent population health research center at University of Washington, has developed some models for Covid-19 and how daily infections might model out over the next few months. See the chart below. As you can tell from the chart, they are forecasting a spike should easing (red line) of restrictions be done too soon. Should a full national mask mandate (green line) be implemented, they are forecasting that would reduce daily infections. The current projection (purple line), is that daily infections should continue to decline in the second quarter of 2021 to a potential point of containment.

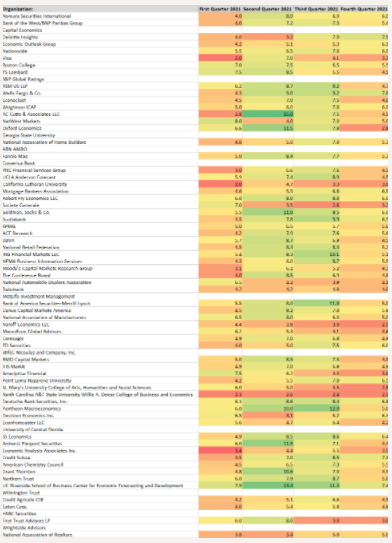

Robinson Analytics current United States economic growth forecast for 2021 is 5.1 % (up from 3.6% in my December 2020 forecast). The policies that have been implemented over the past four years are going to propel us into spectacular growth this year. My current estimate is that the U.S. will fully recover from the 2020 recession by January of 2022 (up from second quarter of 2022 in my December 2020 forecast). So my forecast has improved since December 2020. Below find a table that depicts growth rates for the economy by a number of firms by quarter on an annual basis.

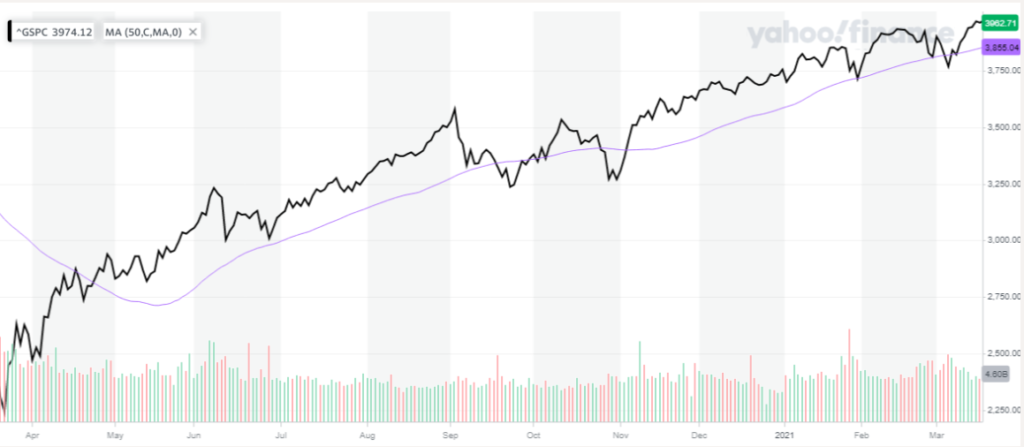

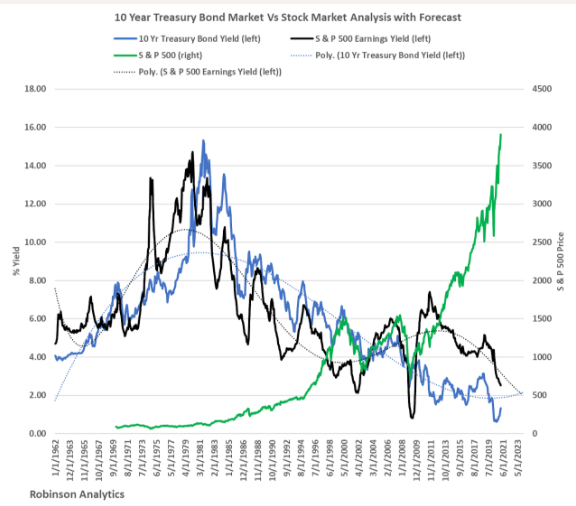

When I take a look at what the Standard and Poor’ 500 is forecasting for the new year, or better known as the stock market, it is telling us that the economy will be growing over the next 6 to 9 months. So it corroborates the fundamental analysis that is depicted by the above firms. So I am not estimating a decline in the economy for the year at this time.

When I take a look at what the 10 Year United States Treasury bond market is currently forecasting, it is telling us that the economy is still in an expansion phase and growing. If you look at the blue line in the chart below, you can see the yield of the 10 Year improving. So it corroborates the fundamental analysis that is depicted by the above firms and the stock market.

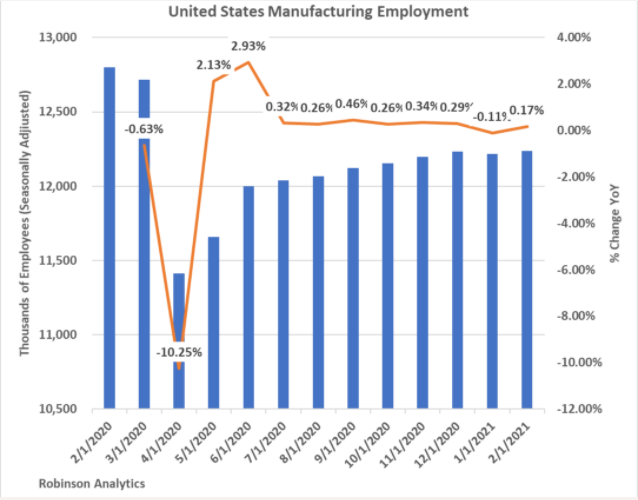

Even though manufacturing only accounts for ~11% of our economy, this sector of the economy is very important in that it is a leading economic indicator. In other words, manufacturing employment tells us whether the economy is going to contract or expand in the future. Manufacturing employment has not recovered to pre-pandemic levels as of February 2021. Employment has been growing since May of 2020 until January of this year, when it declined for the first time since May. However, growth did recover in February. We will have to see if this develops into a trend. (Note: Biden’s tax plan as proposed will be a headwind to manufacturing in the U.S. See the note below.)

How will Biden’s proposed tax plan affect the U.S. economy?

President Joe Biden’s proposed tax plan would raise taxes on high-income households and corporations. At the same time, he plans to increase tax credits for many low- and moderate-income families. Biden’s plan would repeal many of the tax cuts outlined in the Trump-sponsored Tax Cuts and Jobs Act (TCJA).

Biden would make the tax code more progressive, meaning more affluent households would pay taxes at a higher rate than low-income taxpayers.

By 2030, Biden’s tax increases would reduce after-tax income by 7.7% for the top 1% of taxpayers. The net effect of the biggest changes is to increase federal revenue by $3.3 trillion over 10 years. Like any tax increase, the plan would also reduce economic growth—in this case, by 1.62% over 10 years—which would lower the number of full-time jobs by 542,000.

In summary,Biden has been adamant that he won’t raise taxes on households making less than $400,000 a year.

However, costs will rise for all families as corporate taxes increase. To stay in business, companies must maintain a certain profit margin. So higher corporate taxes mean firms will either raise prices or cut costs, possibly by lowering wages or even laying off workers. Shareholders could also be hurt by lower corporate investment returns. In the long run, families who make less than $400,000 a year could be affected indirectly by Biden’s tax plan.

“We use analytics on your work and business processes to gather the critical insights that you need to impact your business performance.” Click here to schedule a complimentary discussion session about how Robinson Analytics can help you. To learn more, you can access his website at www.robinsonanalytics.com.