Robinson Analytics Real Estate Market Analysis

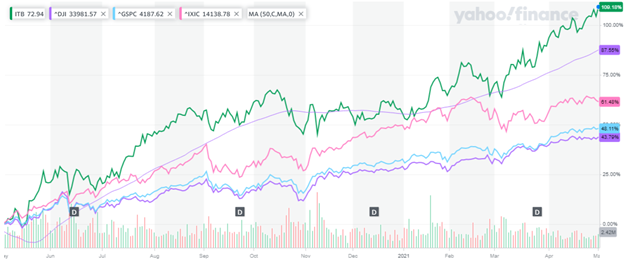

The United States real estate market has been one of the best performing equity asset classes year to date risk adjusted. This sector (XLRE, green line in the chart below) of the economy has outperformed the Standard & Poor’s 500 (Economy overall), Nasdaq (Technology sector of the economy) and the Blue-Chip firms that we know as the Dow Jones Industrial Average. See the chart below. So, it got my attention.

Robinson Analytics takes data science and applies it to the Stock Market to provide you with some of the highest-return investment ideas. To learn more about Robinson Analytics Investment Newsletter, click here.

The investment (XLRE) seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of publicly traded equity securities of companies in the Real Estate Select Sector Index

In this analysis I am going to provide some insights into the residential, commercial and industrial sub-sectors of the real estate market.

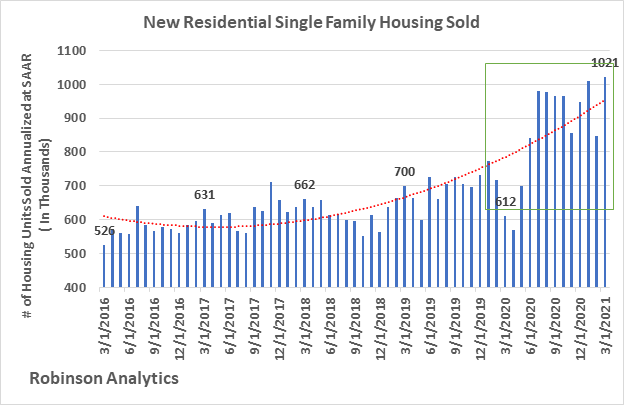

When I take a look at the micro sector of new residential sales, it has performed significantly better than the economy over all on a Year Over Year basis. See the chart below. This chart is communicating to me that new residential construction is really, really strong. This is confirmed by new residential home sales data. As you can see from the chart below on new residential home sales data, we are at a 5 year high in new home sales. Sales in March 2021 are up 66% versus March of 2020.

The investment (ITB EFT) seeks to track the investment results of the Dow Jones U.S. Select Home Construction Index composed of U.S. equities in the home construction sector.

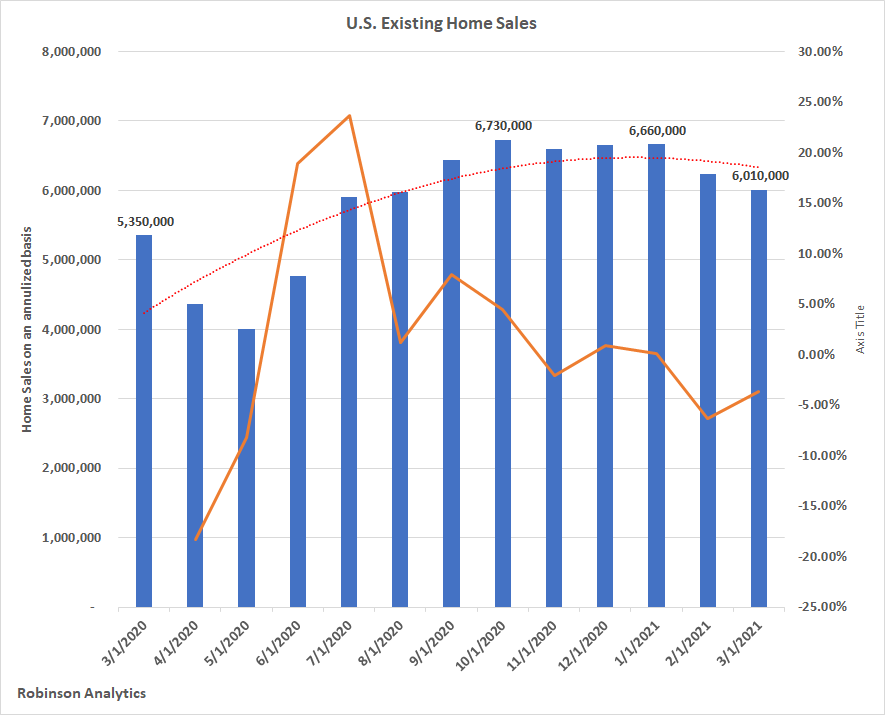

When I take a look at the existing home sales micro-sector of the residential real estate market, we have had a strong rebound from the GVC (Great Virus Crisis) shut-down last year. However, it looks like the sales rate of existing home sales is slowing, even though existing home sales are up 12% YoY. So, it would seem that the excitement is in new home sales nationally at this point.

Read this article...Home prices are up 17% over the past year, while inventory remains low: Redfin

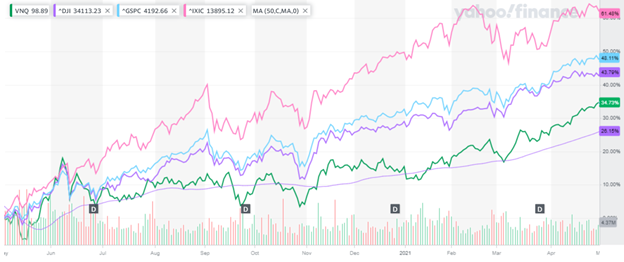

In taking a look at the commercial real estate market, you can see from the chart below, that this sub-sector (VNQ ETF) of the real estate market has underperformed the market or general economy overall. See the green line in the chart below.

As you can see, this sub-sector ETF is up 34% YoY. This communicates to me that the demise of the commercial real estate market has been over hyped. It is performing worst than the economy over all. That is for sure. However, the market is not communicating the collapse of commercial real estate at this time.

The investment (VNQ ETF) seeks to provide a high level of income and moderate long-term capital appreciation by tracking the performance of the MSCI US Investable Market Real Estate 25/50 Index that measures the performance of publicly traded equity REITs and other real estate-related investments.

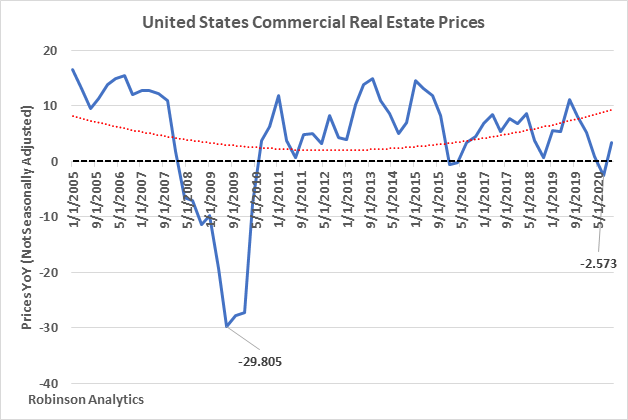

Commercial real estate prices did have two quarters of decline last year, but have started to grow again (See chart below.)

When I take a look at the industrial real estate sub-sector, it is doing better than the commercial real estate market. For example, the commercial real estate ETF is up 34% versus the industrial real estate ETF (INDS) is up 45%. The industrial space has performed better during the GVC and will continue so going forward.

The industrial market has performed on par with the general economy overall. So, there is no outsize performance here, but for all extensive purposes, will not be a laggard to the economy overall. See the green line in the chart below.

The investment (INDS) seeks to track the total return performance, before fees and expenses, of the Benchmark Industrial Real Estate SCTR Index.

In Summary, the real estate market should continue to improve throughout 2021 as the economy improves. Companies are starting to announce plans for employees to return to the office in the second part of the year. However, there will be changes in how corporations manage their commercial real estate that will be a drag on this market. My forecast is that commercial will grow but will be the worst performing sub-sector of the real estate market this year.

The industrial real estate market will be stronger this year than commercial. However, this market will only perform as well as the economy overall. So we should see better growth in the industrial space then we see in the commercial space.

The residential sub-sector of the market will be mixed. The new residential housing market is red-hot and should perform very well for the remainder for of 2021 for a number of reasons. There is just too much demand for new housing versus new housing supply. This should help to propel a very strong market. However, the existing home micro-sector is slowing. It has been slowing since October of 2020.

“We use analytics on your work and business processes to gather the critical insights that you need to impact your business performance.” Click here to schedule a complimentary discussion session about how Robinson Analytics can help you. To learn more, you can access his website at www.robinsonanalytics.com.