How will President Biden’s proposed Corporate tax hike affect wage and job growth?

You have seen some of the recent headlines around President Biden’s Corporate tax hike to 28%. He is proposing to raise the taxes on Corporations as a way to pay for his 2 trillion dollar infrastructure plan. See the headlines below…

The focus of this article is not to articulate the need for infrastructure to be invested in. It surely does and has been under invested in for years. However, the focus of this article is to take a look at how this Corporate tax hike will affect wage and job growth in the United States if it passes as proposed.

The Tax Foundation has spent some time studying President Biden’s ideas around this tax hike. Below is a summary of their key findings.

Key Findings

- President Joe Biden and congressional policymakers have proposed several changes to the corporate income tax, including raising the rate from 21 percent to 28 percent and imposing a 15 percent minimum tax on the book income of large corporations. The proposals are being considered to raise revenue for new spending programs and would repeal changes to the corporate tax made by the Tax Cuts and Jobs Act (TCJA) in late 2017.

- An increase in the federal corporate tax rate to 28 percent would raise the U.S. federal-state combined tax rate to 32.34 percent, highest in the OECD and among Group of Seven (G7) countries, harming U.S. economic competitiveness and increasing the cost of investment in America. We estimate that this would reduce long-run economic output by 0.8 percent, eliminate 159,000 jobs, and reduce wages by 0.7 percent. Workers across the income scale would bear much of the tax increase. For example, the bottom 20 percent of earners would on average see a 1.45 percent drop in after-tax income in the long run.

- A minimum tax on the book income of large corporations would target gaps between financial and taxable income that generally exist because the rules for taxation differ from standards for reporting income to shareholders. Such a minimum tax would likely introduce additional complexity and distortions into the tax code and generate relatively little tax revenue, in part because firms have a degree of flexibility in reporting book income. The tax would potentially undermine current-law investment incentives as well as those proposed by President Biden, such as the “Made in America” tax credit.

(To view her April 8, 2021 interview on CNBC, click the graphic)

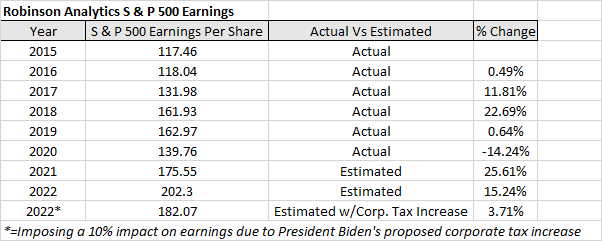

When I take a look at how this increase in the tax rate would impact corporate earnings, studies are estimating that corporate earnings would be impacted negatively to the tune of ~10%

As you can see from the table above, S & P 500 stock earnings would be reduced by ~12 PPTs. Corporations will need to make this up from some where. So the short-term benefit of increased infrastructure spending over a 10 year period will be off-set by a long-term change in the Corporate tax structure. Which will manifest itself in Corporate behavior, such as,

- Reduction in jobs that they are looking to fill,

- Suppression of wage growth to keep down costs,

- Moving operations to more cost effective locations globally,

- Potentially laying off personnel,

- Increasing the use of technology, so as to minimize headcount.

Take look at a recent published article about National Manufacturing Association study of the proposed tax hike…

Business group’s study says corporate tax hike would cost 1M jobs (The Hill, April 8, 2021) One million jobs would be lost in the first two years if the corporate tax rate increased to 28 percent and other policies went into effect, according to a new study from the National Association of Manufacturers (NAM).

I believe that these ideas as proposed, would have a significant impact on jobs and wage growth if implemented. You would start to see the changes in Corporate behavior in 2022, if not before.

“We use analytics on your work and business processes to gather the critical insights that you need to impact your business performance.” Click here to schedule a complimentary discussion session about how Robinson Analytics can help you. To learn more, you can access his website at www.robinsonanalytics.com.